Nomad Insurance For Multiple Countries

Nomad Insurance for Multiple Countries is essential for today’s adventurous travelers who thrive on exploring diverse cultures and landscapes. This type of insurance offers a tailored approach to coverage, ensuring that nomads can travel freely without the worry of unforeseen incidents. With a variety of plans available, travelers can find policies that meet their unique needs and provide essential protections across multiple destinations.

Understanding the significance of this insurance is crucial—it’s not just about medical emergencies; it’s about safeguarding yourself from cancellations, lost belongings, and other unexpected events that can disrupt your journey. Nomad insurance acts as your safety net, allowing you to focus on your travels while ensuring you have the necessary support wherever the road takes you.

Understanding Nomad Insurance: Nomad Insurance For Multiple Countries

Nomad insurance is a specialized form of coverage designed for individuals who travel frequently, often working and living in different countries. As the world becomes more interconnected, the need for tailored insurance solutions has grown, accommodating the unique risks and requirements of modern-day nomads. This type of insurance plays a crucial role in protecting travelers from unforeseen incidents, ensuring that they can focus on their adventures without the burden of financial worry.

Nomad insurance typically offers comprehensive coverage that is distinct from traditional travel insurance. The emphasis is on long-term protection rather than just short trips, making it ideal for digital nomads, expatriates, or anyone who spends an extended period abroad. Below are the different types of coverage usually included in nomad insurance policies:

Types of Coverage Offered

The coverage options provided by nomad insurance can vary significantly between providers, but generally include the following:

- Health Insurance: Covers medical expenses incurred while traveling, including hospital stays and emergency services.

- Trip Cancellation or Interruption: Reimburses travelers for non-refundable expenses if a trip is canceled or interrupted due to unforeseen events.

- Personal Liability: Protects against legal claims for injuries or damages caused to others during the trip.

- Emergency Evacuation: Ensures coverage for transportation to a medical facility in case of an emergency.

- Lost or Stolen Belongings: Provides compensation for lost, stolen, or damaged personal items during travel.

These coverage types address the various scenarios that frequent travelers may encounter, offering peace of mind during their journeys.

Key Features Distinguishing Nomad Insurance

Nomad insurance possesses several defining features that set it apart from conventional travel insurance, making it more suitable for long-term travelers. These features include:

- Extended Coverage Duration: Unlike traditional policies that often limit coverage to a specific period, nomad insurance typically allows travelers to purchase coverage that lasts for months or even years.

- Flexibility in Location: Many nomad insurance plans provide global coverage, accommodating the frequent movement between different countries without the need for additional policies.

- Adaptability to Lifestyle Changes: Policies can often be adjusted to suit changing travel plans or lifestyles, catering to the needs of digital nomads or expatriates.

- Higher Coverage Limits: Nomad insurance generally offers higher limits on medical expenses and other claims, reflecting the potential risks associated with living abroad.

Nomad insurance is designed not just for trips, but for the lifestyle of constant exploration and adaptability.

By understanding these key aspects of nomad insurance, travelers can make informed decisions that enhance their travel experiences and provide security in the face of the unexpected.

Benefits of Nomad Insurance for Multiple Countries

Nomad Insurance offers a unique advantage for travelers seeking coverage while exploring various countries. This type of insurance is designed specifically for digital nomads, remote workers, and adventurous globetrotters who often find themselves moving across borders. With Nomad Insurance, individuals can enjoy the benefits of comprehensive coverage tailored to their transient lifestyles, providing a safety net no matter where they roam.

Having insurance that spans multiple countries is invaluable for those who travel frequently. It not only simplifies the process of securing adequate health and travel protection but also ensures that travelers are covered for unexpected events, regardless of their current location. For instance, if a digital nomad falls ill while working from a café in Bali, they can rest assured knowing their medical expenses will be taken care of, even though they are miles away from their home country.

Scenarios Showcasing the Value of Nomad Insurance

There are numerous situations where Nomad Insurance proves to be especially beneficial for travelers. Here are some examples that highlight its importance:

- Medical Emergencies: If a traveler has an accident while hiking in Patagonia, having Nomad Insurance means they can access immediate medical care without worrying about exorbitant out-of-pocket costs.

- Trip Cancellations: A digital nomad may have to cancel their plans due to unforeseen circumstances such as a family emergency. Nomad Insurance can help recover non-refundable travel expenses, minimizing financial loss.

- Theft or Loss of Belongings: Imagine losing a laptop filled with crucial work documents during a trip to Europe. Nomad Insurance provides coverage for stolen items, allowing the traveler to replace their equipment swiftly.

- Natural Disasters: If a nomad is caught in a natural disaster, such as an earthquake while visiting Japan, insurance can cover evacuation costs and emergency accommodations, ensuring their safety is prioritized.

With coverage that includes international medical care, protection against trip cancellations, and personal property loss, Nomad Insurance significantly enhances the travel experience.

“Traveling without insurance is like sailing without a life jacket—you’re unprepared for the unexpected.”

This peace of mind stems from the knowledge that no matter where one finds themselves in the world, they have reliable support. Nomad Insurance is more than just a policy; it is a commitment to ensuring safety, health, and financial security, allowing travelers to focus on what truly matters—embracing new experiences and adventures in unfamiliar lands.

Selecting the Right Nomad Insurance Provider

Finding the right nomad insurance provider can be a game-changer for your travels across multiple countries. With so many options available, it’s crucial to choose a plan that fits your unique lifestyle and travel needs. The right insurance will not only offer peace of mind but also ensure that you’re protected from unexpected expenses while you explore the world.

When comparing various insurance providers, look for those that specialize in nomad insurance and offer services tailored for international travelers. Each insurance provider has its own strengths and weaknesses, so it’s essential to evaluate them based on specific criteria that matter most to you.

Criteria for Evaluating Nomad Insurance Plans

Selecting a suitable nomad insurance plan involves considering several key factors. Here are some important criteria to keep in mind when evaluating different options:

- Coverage Options: Check what types of coverage are included, such as emergency medical, trip cancellation, and lost luggage. Comprehensive plans provide more extensive coverage.

- Geographic Coverage: Ensure the plan covers all the countries you plan to visit. Some providers may have restrictions on certain regions.

- Claim Process: Investigate how easy it is to file a claim. A straightforward, efficient claims process can save you time and stress in emergencies.

- Customer Support: Look for providers that offer 24/7 customer support, especially if you’re traveling across different time zones.

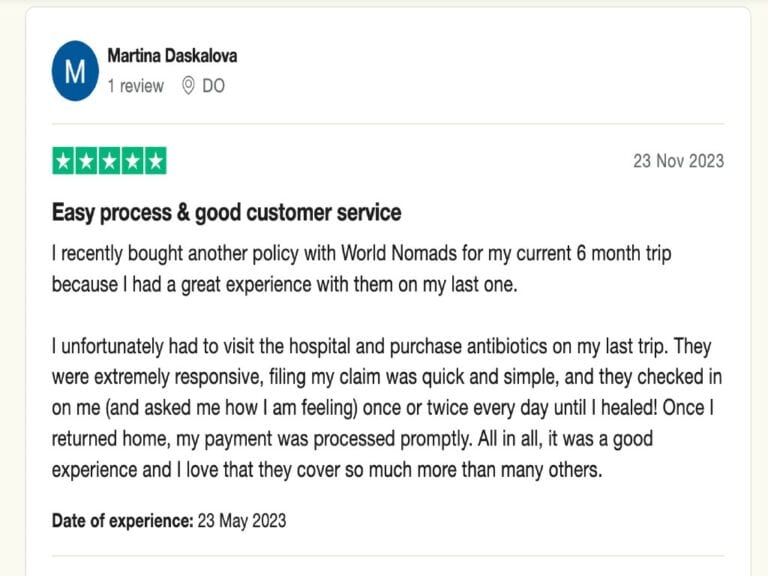

- Reputation and Reviews: Read reviews and testimonials from other nomads. A provider with a solid reputation can give you more confidence in choosing them.

The above criteria can guide you in selecting the most suitable insurance provider for your nomadic lifestyle.

Understanding Insurance Policy Terms and Conditions

Reading and understanding the terms and conditions of an insurance policy can be daunting but is essential to avoid unpleasant surprises later. Here are some tips to navigate this crucial step effectively:

- Look for Definitions: Familiarize yourself with key terms that may be used in the policy, such as “deductible,” “exclusions,” and “limits.” Understanding these can clarify what is covered and what isn’t.

- Pay Attention to Exclusions: Focus on the exclusions section of the policy. Knowing what is not covered will help you understand the limitations of your insurance.

- Clarify Coverage Limits: Ensure you understand the maximum amount the insurance will pay for different types of claims. This can vary greatly between policies.

- Check for Policy Duration: Make sure the policy duration aligns with your travel plans. Some providers may have restrictions on how long you can be covered.

- Contact Customer Support: If any part of the policy is unclear, don’t hesitate to reach out to the provider’s customer support for clarification. This can save you potential headaches in the future.

By taking the time to thoroughly assess your options and understand the policy terms, you can make an informed decision that aligns with your travel aspirations.

Common Exclusions in Nomad Insurance Policies

Nomad insurance can be an essential safety net for travelers who frequently move between countries, but it’s crucial to understand that not all situations are covered. Exclusions in these policies can significantly impact the support you receive during your travels, so being aware of them is vital for making informed decisions.

While the core purpose of nomad insurance is to provide coverage for unexpected incidents abroad, each provider has different terms, and exclusions can vary widely. Understanding these exclusions helps you avoid surprises when you need assistance most. Some policies may cover extreme sports, while others may not; thus, it’s essential to read the fine print.

Typical Exclusions in Nomad Insurance

Many nomad insurance policies come with common exclusions that can limit the extent of coverage. Familiarizing yourself with these exclusions is important for ensuring your expectations align with your travel plans. Below is a list of common activities and scenarios that are typically not covered:

- Pre-existing medical conditions: Most policies exclude any medical issues that existed before purchasing the insurance.

- High-risk activities: Activities such as skydiving, rock climbing, or scuba diving may be excluded unless additional coverage is purchased.

- War and terrorism: Coverage for injuries or damages resulting from acts of war or terrorism is often limited or excluded altogether.

- Natural disasters: Incidents like earthquakes or floods may not be covered, depending on the policy.

- Deliberate self-harm: Any injuries incurred through self-inflicted actions are usually excluded.

- Alcohol or drug-related incidents: Claims resulting from intoxication or drug use are generally not supported.

- Non-emergency medical treatments: Routine check-ups or non-urgent care often fall outside the coverage scope.

These exclusions are critical to note as they can vary significantly between different insurance providers. Each company may have its own specific clauses that define the limits of coverage, which could lead to major differences in what you can expect when filing a claim. Carefully comparing these policies is essential before committing to a plan.

“Understanding the exclusions in your nomad insurance policy is just as important as knowing what is covered.”

Claim Process for Nomad Insurance

Filing a claim with your nomad insurance provider can seem daunting, but understanding the process can simplify the experience significantly. Whether you’re dealing with a medical emergency, trip cancellation, or lost belongings, knowing the steps to take can help you navigate the claim process smoothly and efficiently.

When you find yourself in a situation requiring a claim, it’s essential to follow specific steps laid out by your insurance provider. This typically involves notifying the insurer promptly, gathering necessary documentation, and submitting a claim form. Each provider may have unique nuances to their process, but the general framework remains quite similar.

Steps to File a Claim

It’s vital to approach your claim methodically to ensure it’s processed quickly. Here are the typical steps involved in filing a claim with a nomad insurance provider:

- Notify your insurance provider: Contact your insurer as soon as possible after the incident. Most providers have a dedicated claims hotline or online portal for this purpose.

- Complete the claim form: Fill out the required claim form accurately, detailing the incident and the extent of your loss or injury.

- Gather supporting documentation: Collect all necessary documents that substantiate your claim, as Artikeld in the next section.

- Submit your claim: Send your claim form and supporting documents to your insurance provider through the specified method (online, by email, or by post).

- Follow up: Keep track of your claim status by following up with your provider, especially if you haven’t received confirmation within their specified timeframe.

Documentation and Evidence Needed

To support your claim effectively, you’ll need to provide specific documentation and evidence that verifies your loss or injury. This could include:

“Proper documentation is crucial to a successful claim.”

The following items are commonly required:

- Claim form: The completed claim form, detailing your personal information and specifics of the incident.

- Receipts: Original or photocopies of any relevant receipts for expenses incurred (like medical bills, hotel stays, etc.).

- Police reports: If applicable, a copy of any police reports related to theft or accidents.

- Medical records: Documentation from healthcare providers if the claim is related to medical treatment.

- Photographic evidence: Photos of damage or loss can serve as strong evidence to support your claim.

Checklist for Travelers Before Filing a Claim

Preparing adequately can alleviate stress when you need to file a claim. Here’s a checklist to ensure you have everything in order:

“Preparation is key to a successful claims process.”

– [ ] Confirm your insurance policy details and coverage limits.

– [ ] Collect all relevant receipts and invoices.

– [ ] Document the incident with photographs and notes.

– [ ] Obtain a copy of any police or incident reports, if applicable.

– [ ] Fill out the claim form thoroughly and accurately.

– [ ] Keep copies of all documents submitted for your own records.

– [ ] Note down your insurance provider’s contact information for future reference.

By following these guidelines, travelers can manage the claim process effectively, ensuring they have the support they need during challenging times.

Cost Considerations for Nomad Insurance

When it comes to nomad insurance for multiple countries, understanding the costs involved is crucial for making an informed decision. The cost of your policy can vary widely based on several factors, including your age, health status, the countries you plan to visit, and the coverage level you choose. It’s essential to evaluate these factors carefully to find a plan that meets your needs without breaking the bank.

Several factors influence the cost of nomad insurance, and being aware of these can help you navigate the options available. Key elements to consider include:

Factors Influencing Cost

The cost of nomad insurance is shaped by various elements that reflect both your personal profile and the specifics of your travel plans. Understanding these factors can empower you to choose a more suitable insurance plan.

- Age: Generally, younger travelers pay less for insurance compared to older individuals due to lower health risks associated with youth.

- Destination: Countries with higher healthcare costs, such as the USA or Australia, will typically increase your premium. Traveling to multiple countries can also complicate coverage, affecting the price.

- Duration of Coverage: Longer trips often lead to higher premiums, so consider the length of your stay in each country.

- Health Status: Pre-existing medical conditions can raise your insurance costs significantly, as insurers may view you as a higher risk.

- Coverage Level: Higher coverage limits and additional benefits, such as emergency evacuation or personal liability, will impact the overall cost.

Potential Costs Associated with Different Levels of Coverage

Different levels of coverage can significantly affect the premium you pay. Generally, the more comprehensive the policy, the higher the cost. Here’s a breakdown of potential costs for varying levels of coverage:

| Coverage Level | Average Monthly Cost | Description |

|---|---|---|

| Basic Coverage | $30 – $70 | Covers essential medical expenses and travel emergencies. |

| Standard Coverage | $70 – $150 | Includes additional benefits like trip cancellation and lost luggage. |

| Comprehensive Coverage | $150+ | Offers extensive protection, including high medical limits and personal liability. |

Finding affordable nomad insurance doesn’t mean you have to sacrifice coverage. Here are some tips to help you secure a good deal:

Tips for Finding Affordable Nomad Insurance

Navigating the world of nomad insurance can be daunting, but there are strategies to help you find a policy that fits your budget.

- Compare Quotes: Use online comparison tools to gather quotes from different providers. This allows you to find the best rates and coverage options available.

- Bundle Policies: If you already have insurance (like home or auto), check if your provider offers a discount for bundling travel insurance.

- Read the Fine Print: Be cautious of policies with hidden fees or exclusions that may lead to higher costs in the event of a claim.

- Consider Annual Plans: If you travel frequently, an annual plan can be more cost-effective than purchasing a separate policy for each trip.

- Choose a Higher Deductible: Selecting a higher deductible can lower your premium, but ensure you can afford the deductible in case you need to file a claim.

Understanding the various cost considerations associated with nomad insurance can help you find a policy that meets your travel needs while staying within your budget.

Real-Life Examples of Nomad Insurance Claims

Nomad insurance serves as a crucial safety net for travelers venturing across the globe, providing peace of mind and financial protection against unforeseen circumstances. Real-life scenarios demonstrate how effective this coverage can be when unexpected events arise during travels. These case studies not only highlight the benefits of having nomad insurance but also showcase the various ways it comes into play in different situations.

Case Studies of Nomad Insurance Claims

In this section, we explore several detailed examples where travelers have benefited from nomad insurance, showcasing the diversity of claims and the lessons learned from each incident.

| Traveler | Incident | Claim Outcome | Lessons Learned |

|---|---|---|---|

| Alice, 29 | Hospitalization due to a severe allergic reaction in Thailand | Claim covered emergency medical expenses up to $10,000 | Importance of disclosing pre-existing conditions. |

| Mark, 35 | Theft of personal belongings in Barcelona | Claim reimbursed stolen items valued at $2,500 | Keep an inventory of valuable items for easier claims. |

| Sara, 27 | Flight cancellation due to a natural disaster in Bali | Claim covered additional accommodation and travel costs | Always read the cancellation policy in depth before purchasing. |

| Tom, 40 | Emergency evacuation from a remote area in Peru due to an accident | Claim covered evacuation costs exceeding $15,000 | Choose a plan with robust emergency evacuation coverage. |

The cases above illustrate the myriad of situations where nomad insurance proved invaluable. Each incident not only had its unique challenges but also provided key insights for travelers. For instance, Alice’s experience emphasized the critical need to declare pre-existing health conditions when applying for coverage. Similarly, Mark’s situation highlighted the benefit of maintaining a record of valuable items to simplify the claims process.

“Nomad insurance is not just a backup; it’s a reliable companion that safeguards your adventures.”

Ultimately, these examples reflect the diverse experiences of travelers and reinforce the importance of having comprehensive nomad insurance. Understanding the claim process and being prepared can significantly enhance a traveler’s safety and enjoyment while exploring new destinations.

Future Trends in Nomad Insurance

As the world continues to evolve, so does the landscape of nomad insurance. With an increasing number of people opting for remote work and travel, the demand for flexible and comprehensive insurance options has surged. This segment delves into the emerging trends shaping the nomad insurance market, the role of technology in enhancing coverage, and potential regulatory changes that could impact policy offerings.

Technological advancements are transforming the travel insurance industry, making it more accessible and user-friendly. Digital platforms are streamlining the process of purchasing and managing insurance, while data analytics are enhancing risk assessment and customer service.

Emerging Trends in Nomad Insurance, Nomad Insurance for Multiple Countries

The nomad insurance market is witnessing several trends that reflect changing consumer behavior and technological innovations. One significant trend is the shift towards personalized insurance products that cater to individual needs.

- Increased Customization: Insurers are offering tailored policies that allow nomads to select coverage based on their specific travel patterns and activities, ensuring better protection.

- Short-Term Coverage: With more people traveling for shorter durations, insurers are creating flexible options that provide coverage for brief trips, accommodating spontaneous travel plans.

- Integration with Technology: Many insurance providers are utilizing mobile applications to allow policyholders to easily access their coverage details, submit claims, and receive assistance while on the go.

- Focus on Wellness: Insurers are beginning to recognize the importance of health and wellness in travel insurance, offering options that include telehealth services and wellness check-ups.

Impact of Technological Advancements

Technological advancements are revolutionizing how nomad insurance is delivered and experienced. The integration of innovations such as artificial intelligence and machine learning is enhancing customer interactions and operational efficiency.

- AI-Powered Chatbots: These are being deployed by insurance companies to provide 24/7 customer support, answer queries, and guide users through the claim process, improving the overall experience.

- Usage-Based Insurance: With the rise of data collection tools, insurers are developing pay-as-you-go models that allow nomads to pay based on their actual travel habits, making insurance more cost-effective.

- Blockchain Technology: This offers enhanced security and transparency in claims processing, reducing fraud and ensuring quicker payouts for legitimate claims.

- Mobile App Innovations: Providers are creating comprehensive apps that not only sell policies but also offer travel assistance, emergency contacts, and real-time updates on coverage status.

Potential Changes in Regulations

As the nomad lifestyle becomes increasingly mainstream, regulatory frameworks are likely to evolve to better protect consumers. Anticipated changes may include new guidelines for cross-border insurance provisions.

- Standardization of Policies: Regulators may push for more standardized coverage options that ensure consistency in what nomad insurance can offer across different countries, providing clarity for consumers.

- Consumer Protection Laws: There may be enhancements in laws that protect travelers from unfair practices in the insurance sector, ensuring that policies are clear and comprehensive.

- Cross-Border Insurance Regulations: As more individuals travel and work across borders, there could be initiatives to simplify the legal complexities surrounding the enforcement of insurance policies internationally.

- Focus on Sustainability: With rising awareness about environmental issues, regulations may encourage insurance providers to develop policies that promote sustainable travel practices.

Ending Remarks

In conclusion, Nomad Insurance for Multiple Countries is a vital resource for travelers looking to explore the globe with confidence. As we’ve discussed, having comprehensive coverage provides peace of mind and protection against a range of potential risks. By choosing the right provider and understanding your policy, you can embark on your adventures knowing you are well-prepared for whatever challenges may arise.

Query Resolution

What is Nomad Insurance?

Nomad Insurance is a specialized coverage designed for frequent travelers, providing protection for various risks encountered while traveling in multiple countries.

Do I need Nomad Insurance if I have regular travel insurance?

Regular travel insurance may not cover the unique needs of long-term travelers or those visiting multiple countries, making Nomad Insurance a better fit for many.

How do I choose the right Nomad Insurance policy?

Consider factors such as coverage limits, exclusions, and the specific needs of your travel itinerary when selecting a policy.

Can I claim for lost items while traveling?

Yes, most Nomad Insurance policies cover lost or stolen personal belongings, but always check the specific terms of your policy.

What activities are usually excluded from Nomad Insurance?

Common exclusions include extreme sports, pre-existing medical conditions, and any illegal activities; always review your policy for specific exclusions.