Family Health Insurance For Digital Nomads

Family Health Insurance for Digital Nomads opens up a vital discussion about ensuring your loved ones are protected while you explore the world. As more families embrace a nomadic lifestyle, understanding the unique aspects of health insurance becomes crucial. Navigating healthcare while traveling can be daunting, but with the right insurance, you can focus on adventures rather than worries.

This guide delves into the importance of family health insurance tailored for digital nomads, the types of plans available, and key factors to consider when choosing the best coverage. Whether you are opting for local or international plans, knowing what fits your family’s needs will empower you to travel confidently.

Overview of Family Health Insurance for Digital Nomads

Family health insurance is a critical consideration for digital nomads who travel and work remotely while maintaining family responsibilities. Unlike traditional insurance, which often caters to fixed locations and specific demographics, family health insurance for digital nomads is designed to provide comprehensive coverage that adapts to the unique lifestyle of a family on the move. This flexibility ensures that families can access healthcare services wherever their travels may take them, providing peace of mind in often unpredictable circumstances.

Family health insurance differs from traditional health insurance in several key ways. Traditional plans are typically bound by geographical limitations and may not cover international medical facilities. In contrast, family health insurance for digital nomads offers global coverage that allows families to seek medical attention worldwide without facing exorbitant out-of-pocket expenses. It also often includes provisions for telemedicine services, essential for nomadic families who may find themselves in remote locations with limited access to healthcare facilities.

Key Components of Family Health Insurance for Digital Nomads

Understanding the key components that make family health insurance suitable for digital nomads is essential in selecting the right coverage. These components address the unique needs of families who are constantly on the move, ensuring comprehensive support for health and wellbeing.

The following elements are crucial when considering family health insurance for digital nomads:

- Global Coverage: Ensures that families are protected no matter where they are located, covering both routine and emergency medical services across different countries.

- Flexible Plans: Offers a variety of plan options that can be tailored to meet the specific needs of families, including customizable deductibles and maximum coverage limits.

- Telemedicine Services: Provides access to healthcare professionals through virtual consultations, which is invaluable for families in remote or underserved areas.

- Emergency Evacuation: Includes provisions for medical evacuation to the nearest suitable facility in case of severe medical emergencies, ensuring timely care.

- Family Coverage: Accommodates coverage for all family members, including children, under a single policy, simplifying management and costs.

- Preventive Care Services: Often includes wellness check-ups, vaccinations, and other preventive measures that are essential for maintaining family health while traveling.

“Family health insurance for digital nomads ensures families can access necessary healthcare services wherever they go, providing peace of mind and protection against unforeseen medical expenses.”

Types of Family Health Insurance Plans

Family health insurance is essential for ensuring comprehensive care and financial security while living a mobile lifestyle. Understanding the various types of health insurance plans available to families can help digital nomads make informed decisions that best suit their unique needs. Below, we explore the different categories of family health insurance plans, comparing local and international options, and detailing common coverage choices typically included in these plans.

Categories of Family Health Insurance Plans

There are several types of health insurance plans available for families, each catering to different needs and circumstances. The main categories include:

- Local Health Insurance Plans: These policies are designed to provide coverage within a specific country or region. They often offer lower premiums and are tailored to local healthcare providers and facilities.

- International Health Insurance Plans: Ideal for families traveling or living abroad, these plans provide extensive coverage worldwide, often giving access to a wider network of healthcare providers and facilities.

- Travel Health Insurance Plans: Specifically designed for short-term international trips, these plans typically cover medical emergencies, trip cancellations, and other travel-related issues but may not provide long-term coverage.

- Employer-Sponsored Health Insurance Plans: These plans are provided by an employer and can offer comprehensive family coverage, often at a reduced cost due to group rates.

- Government-Sponsored Health Insurance Plans: Various countries offer government-funded healthcare options that can be beneficial for families, particularly those residing in the country long-term.

Comparing Local and International Health Insurance Plans, Family Health Insurance for Digital Nomads

When evaluating health insurance options, it’s crucial to weigh the benefits and drawbacks of local versus international health insurance plans.

Local plans often provide cost-effective coverage but may limit access to healthcare facilities outside the country. International plans offer broader coverage but tend to come with higher premiums.

- Benefits of Local Plans:

- Lower premiums, making them budget-friendly.

- Access to a network of local healthcare providers.

- Simpler claims process due to familiarity with local regulations.

- Drawbacks of Local Plans:

- Limited or no coverage outside the country.

- Potentially restricted access to specialized treatment options.

- Benefits of International Plans:

- Worldwide coverage ensuring access to medical care while abroad.

- Flexibility in choosing healthcare providers, including specialists.

- Comprehensive care that often includes preventive services.

- Drawbacks of International Plans:

- Higher premiums that may strain the budget.

- Complex claims process that may vary by country.

Coverage Options in Family Health Insurance Plans

When selecting a family health insurance plan, the coverage options available can significantly impact the overall care provided. Common coverage options typically included in family health insurance plans are:

- Hospitalization Coverage: Ensures that family members receive necessary inpatient care without incurring excessive out-of-pocket costs.

- Outpatient Services: Covers routine check-ups, specialist consultations, and diagnostic tests, thus promoting preventive care.

- Prescription Medications: Provides coverage for necessary medications, making it more affordable for families to manage chronic conditions.

- Maternity and Pediatric Care: Ensures comprehensive care for expectant mothers, newborns, and children, including vaccinations and regular check-ups.

- Emergency Services: Covers urgent medical care needed during unforeseen circumstances, including ambulance services and emergency room visits.

Factors to Consider When Choosing a Plan

Selecting the right family health insurance plan is a crucial decision, especially for digital nomads who may be traveling frequently or living in different countries. The right coverage ensures that your family has access to necessary medical care, regardless of location. Understanding the various factors at play can help you navigate through the options available and make an informed choice.

When evaluating health insurance plans, families should consider multiple essential factors that can impact their coverage and financial responsibilities. It’s important to assess how each plan aligns with your family’s needs, lifestyle, and travel patterns.

Essential Factors for Evaluation

To facilitate the selection process, families should ask potential insurance providers key questions that address critical aspects of coverage. Here are some important points to consider:

- Coverage Scope: Determine what medical services are covered, including preventive care, emergency services, and specialist visits.

- International Coverage: Check if the plan provides coverage in all countries you plan to visit and the extent of that coverage.

- Deductibles and Co-Pays: Understand the out-of-pocket expenses associated with the plan, including deductibles, co-pays, and coinsurance.

- Provider Network: Investigate whether there are sufficient providers and facilities available in your travel locations.

- Telehealth Services: Look for options that allow consultations via phone or video, especially while on the move.

- Claim Process: Understand how to file claims and what documentation is required, especially when receiving care abroad.

- Exclusions and Limitations: Review any exclusions or limitations in the policy that may affect your family’s coverage.

Checklist of Questions for Insurance Providers

Here’s a checklist that families can use when speaking to potential insurance providers. These questions can help ensure all critical areas are addressed:

- What is the annual premium and how is it broken down?

- Are there any additional fees for international coverage?

- What is the process for emergency care while abroad?

- Is there a waiting period for coverage on pre-existing conditions?

- What support services are available for international claims?

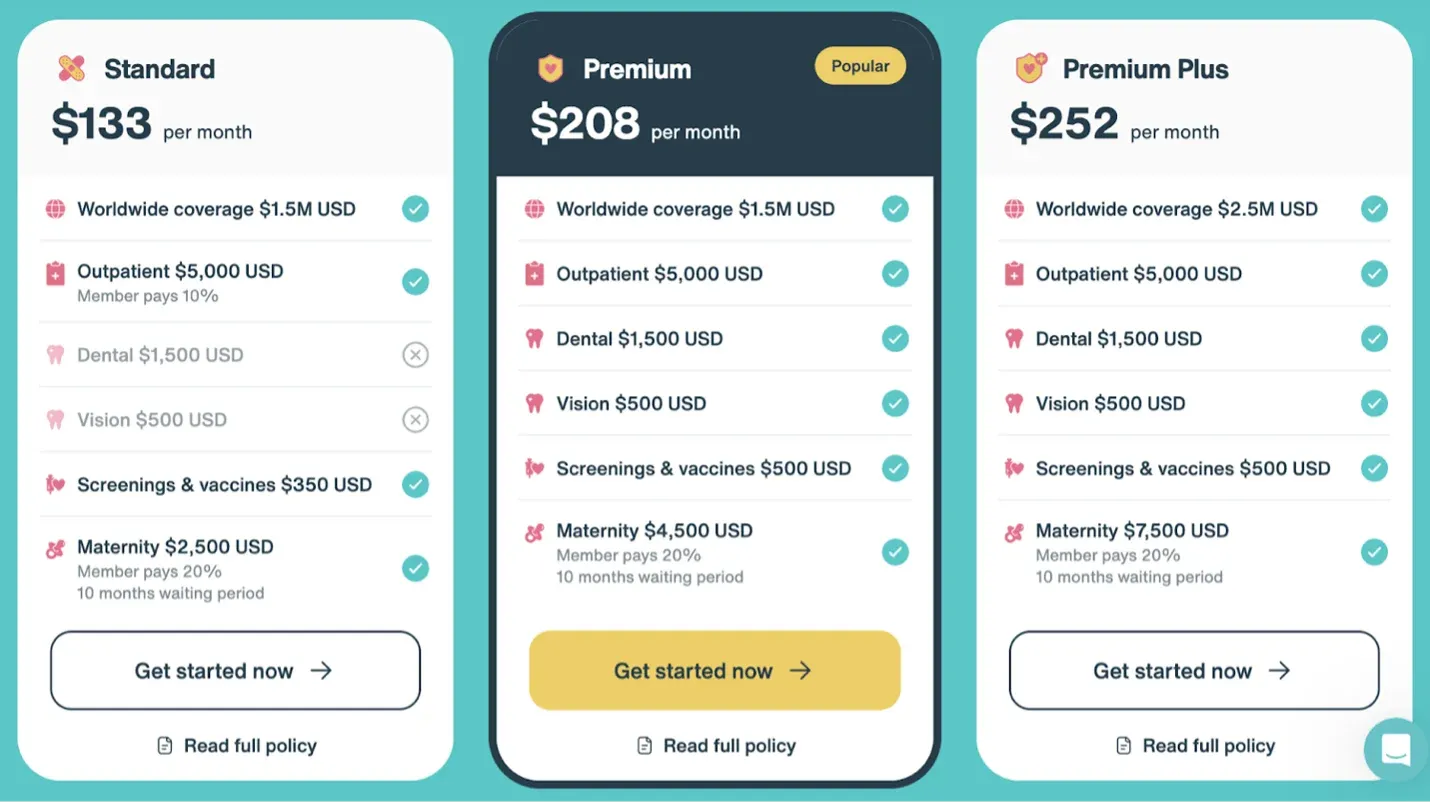

Comparison of Different Insurance Plans

When choosing a family health insurance plan, it can be beneficial to compare different options side by side. The following table highlights key differences among selected plans based on coverage, cost, and provider networks:

| Plan Name | Coverage Type | Monthly Cost | Provider Network |

|---|---|---|---|

| Plan A | Comprehensive | $250 | Global |

| Plan B | Emergency Only | $150 | Limited |

| Plan C | Basic | $200 | Network Providers Only |

| Plan D | Comprehensive with Telehealth | $300 | Global |

“Evaluating and comparing health insurance plans is essential for ensuring that your family’s needs are met while traveling.”

Legal Considerations for Digital Nomads

Navigating the world of family health insurance as a digital nomad involves more than just selecting a plan; it requires a solid understanding of the legal landscape surrounding health insurance in various countries. This understanding is crucial to ensure that coverage is adequate and compliant with local regulations. Digital nomads must be aware of the different legal requirements and their implications on health insurance, as well as how to effectively manage coverage while relocating across borders.

Legal requirements and regulations can significantly impact health insurance for families traveling across countries. Each country has its own laws regarding healthcare and insurance, which can dictate whether foreign insurance is accepted or if local policies must be purchased. Additionally, some countries may require proof of health insurance for visa applications, while others might mandate specific types of insurance that meet local standards.

Implications of Residing in Different Countries

Understanding the implications of residing in different countries is essential for digital nomads when it comes to health insurance coverage. The following factors should be considered when assessing the impact of relocation on insurance:

- Residency Requirements: Some countries classify digital nomads as non-residents, which can affect their eligibility for local healthcare services and insurance options.

- Reciprocal Healthcare Agreements: Certain nations have agreements that allow travelers to access healthcare services without needing to purchase local insurance. Familiarity with these agreements can save costs.

- Coverage Limitations: Policies purchased in one country may not offer coverage in another, making it essential to verify the extent of healthcare access before moving.

- Local Health Insurance Mandates: Some countries require all residents, including expatriates, to have local health insurance, which may necessitate adjustments to existing plans.

Understanding Local Healthcare Systems and Insurance Laws

Gaining insights into local healthcare systems and insurance laws is vital for digital nomads to maintain adequate health coverage. Different countries operate under various healthcare models, and understanding these systems can help in making informed choices regarding insurance:

- Public vs. Private Healthcare: Many countries offer a mix of public and private healthcare, where public services are funded by taxes. Understanding this can guide your choice between local insurance options.

- Insurance Regulations: Each country has its own regulations about what insurance must cover, including pre-existing conditions, hospitalization, and outpatient services. Familiarity with these laws can prevent unexpected costs.

- Language Barriers: Navigating local insurance policies can be challenging due to language differences. It may be beneficial to consult a local expert or use a bilingual plan to avoid misunderstandings.

- Emergency Services: Knowing how to access emergency medical services in a new country is critical. Researching local emergency procedures will ensure you can act swiftly in case of health issues.

Understanding legal requirements and local healthcare systems is crucial for digital nomads to ensure comprehensive family health insurance coverage while traveling.

Cost Management Strategies

Managing health insurance costs is crucial for families, especially for those living the digital nomad lifestyle. With varying healthcare needs and the potential for fluctuating income, it’s essential to adopt effective cost management strategies. By understanding the pricing structures of different providers and exploring financial assistance options, families can secure the health coverage they need without breaking the bank.

One effective strategy for managing health insurance costs involves comparing the pricing structures of various health insurance providers. This comparison enables families to identify the most cost-effective options tailored to their specific needs. It’s important to look beyond premium prices and consider other factors such as deductibles, copayments, and out-of-pocket maximums.

Comparative Analysis of Pricing Structures

When evaluating health insurance providers, families should consider several key elements that contribute to a comprehensive understanding of costs. These include:

- Premiums: The amount paid periodically (monthly, quarterly, or annually) for the health insurance coverage.

- Deductibles: The amount a family must pay out-of-pocket before the insurance coverage begins to pay for services.

- Copayments and Coinsurance: The share of costs after meeting the deductible, which may vary for different services.

- Network Providers: Checking if preferred doctors or hospitals are within the insurer’s network can greatly influence costs.

- Additional Benefits: Some plans offer extra benefits like telehealth services, wellness programs, or preventive care services that can provide long-term savings.

Understanding these elements can help families make informed decisions about which plan offers the best value and coverage for their needs.

Financial Assistance Options and Subsidies

In many regions, families may qualify for financial assistance or subsidies that can significantly reduce their healthcare costs. These options can ease the financial burden and ensure access to necessary medical services. Important assistance opportunities include:

- Government Subsidies: Many countries or states provide subsidies to lower-income families to help them afford health insurance premiums. Eligibility often depends on the household income relative to the federal poverty level.

- Tax Credits: Families may qualify for tax credits that can reduce the amount owed at tax time, effectively lowering overall healthcare expenses.

- Employer Contributions: Some employers offer health insurance plans that include contributions towards premiums, making coverage more affordable for families.

- Health Savings Accounts (HSAs): HSAs allow families to save money tax-free for medical expenses, providing additional financial flexibility.

By exploring these financial assistance options, families can enhance their ability to manage healthcare costs effectively while ensuring that they maintain access to essential medical services.

“Understanding the nuances of health insurance costs can empower families to make better decisions regarding their coverage options.”

Resources and Tools for Finding the Right Insurance

Finding the right health insurance as a digital nomad family can feel overwhelming due to the multitude of options available. Fortunately, there are various online resources and tools designed to simplify the process and help families make informed choices. These resources not only provide valuable information but also allow you to compare different plans and find the best fit for your family’s needs.

An effective way to navigate the landscape of health insurance is by utilizing comparison websites. These platforms can help streamline your search by compiling data from various insurance providers, allowing you to weigh your options side by side. Understanding how to utilize these websites effectively can save you time and ensure you select a plan that meets your requirements.

Online Resources and Tools

When searching for suitable health insurance plans, several online resources can assist families in making sound decisions. Here are some notable options:

- HealthInsurance.org: This website provides a comprehensive overview of different health insurance plans available, along with informative articles and guides specifically tailored to families.

- InsureMyTrip: An excellent resource for travelers, InsureMyTrip offers insurance comparison tools that can help families find travel health insurance that aligns with their travel plans.

- Policygenius: This platform allows users to compare various insurance products, including family health insurance, making it easier to evaluate coverage options and costs.

Navigating Insurance Comparison Websites

To maximize your experience on insurance comparison websites, consider the following tips:

1. Identify Your Needs: Define what type of coverage your family requires, including specific medical needs and travel frequency.

2. Use Filters: Take advantage of filtering options to narrow down your search based on criteria like budget, coverage limits, and specific benefits.

3. Review Plan Details Thoroughly: Examine the fine print of each plan, including exclusions and limitations, to understand what is and isn’t covered.

4. Compare Overall Costs: Look beyond the monthly premium; consider deductibles, co-pays, and out-of-pocket maximums to get a complete picture of potential expenses.

Reputable Insurance Brokers Specializing in Family Health Insurance

Working with an insurance broker who specializes in family health insurance can provide personalized assistance and a deeper understanding of your options. Here are some reputable brokers who cater specifically to digital nomads:

- World Nomads: Known for their expertise in travel insurance, they provide tailored plans for families who travel extensively.

- InsureMyFamily: This brokerage focuses on family-oriented plans, offering a variety of options that cater to digital nomads.

- SafetyWing: With a focus on remote workers and digital nomads, SafetyWing offers a unique insurance product designed specifically for traveling families.

Common Challenges Faced by Digital Nomads: Family Health Insurance For Digital Nomads

Navigating family health insurance while living a nomadic lifestyle presents unique challenges that can complicate the quest for adequate coverage. Digital nomads often find themselves in situations where health insurance options are limited, costs can skyrocket, and understanding local healthcare systems becomes paramount.

One significant challenge is finding a plan that provides comprehensive coverage across multiple countries. Many traditional health insurance plans may offer limited international coverage or exclude certain regions entirely. This results in gaps in protection, especially when families travel frequently or to less well-known destinations.

Insurance Plan Limitations

Limited coverage options frequently lead to confusion and stress. When selecting a family health insurance plan, it’s essential to understand the limitations that may arise. This includes exclusions for pre-existing conditions or specific treatments.

To combat these limitations, consider the following strategies:

- Research international health insurance providers that specialize in digital nomad coverage, such as SafetyWing or World Nomads, as they typically offer more flexible plans.

- Review policy details thoroughly to ensure essential medical services, including emergency care and repatriation, are covered.

Access to Healthcare Services

Accessing healthcare services can be another hurdle for families living the nomadic lifestyle. Depending on the country, healthcare quality can vary significantly, and navigating local healthcare systems often proves challenging.

To ensure families maintain access to necessary medical services, consider these tips:

- Before traveling, research local healthcare facilities to determine what services are available and their quality ratings.

- Establish connections with expatriate communities or online forums where other nomads share experiences about local healthcare options.

Health Insurance Continuity

Maintaining health insurance continuity while frequently changing locations is crucial for digital nomads. Gaps in coverage can lead to complications in receiving necessary medical care and can create financial burdens.

Here are some practical solutions for ensuring continuous coverage:

- Opt for a global health insurance plan that provides continuous coverage regardless of location, allowing families to travel without worrying about losing their benefits.

- Set reminders for policy renewals and monitor coverage dates to avoid unintentional lapses in insurance.

Cost Management of Healthcare Needs

Managing healthcare costs is vital for families on the move. Unexpected medical expenses can quickly add up and derail a family’s budget.

To effectively manage these potential costs, consider the following strategies:

- Utilize health savings accounts (HSAs) to set aside pre-tax funds for medical expenses, which can be beneficial when living abroad.

- Always have a basic understanding of local healthcare costs prior to treatment to budget accordingly and avoid surprises.

“Planning ahead is key for digital nomads; having the right health insurance can make all the difference in maintaining peace of mind while exploring the world.”

Personal Experiences and Testimonials

The journey of digital nomadism is unique for each individual, especially when it comes to finding the right health insurance for families. Many digital nomads have navigated the complexities of securing adequate family health coverage while traveling the globe. Their stories not only provide valuable insights but also highlight the importance of making informed decisions regarding health insurance.

Real-life experiences illustrate the necessity of having the right insurance plan. In the world of digital nomads, where healthcare systems vary dramatically from one country to another, being prepared can make all the difference. Here are some notable case studies and testimonials from nomads who have faced the challenges of health insurance.

Case Studies Highlighting the Importance of Adequate Insurance

Digital nomads often encounter unexpected medical situations that reinforce the need for comprehensive health coverage. Below are examples that demonstrate the consequences of being underinsured or having a plan that doesn’t fit one’s lifestyle.

- Family of Four in Southeast Asia: This family opted for a basic health insurance plan while traveling through Southeast Asia. When one of their children fell ill, they found that their coverage did not include necessary hospitalization. The cost of treatment out-of-pocket was a significant financial burden, teaching them the importance of thorough research before settling on a plan.

- Solo Traveler in Europe: A digital nomad traveling in Europe experienced a severe injury while hiking. Fortunately, their comprehensive travel health insurance covered all medical expenses, including the need for surgery. They shared that this experience solidified their belief in investing in high-quality insurance, especially in regions with expensive healthcare systems.

- Family with Chronic Conditions: One family had a member with a pre-existing condition. They selected a family health insurance plan that adequately covered ongoing treatments. Their testimonial emphasizes that choosing a plan that caters to specific health needs can alleviate stress and ensure continuous care while traveling.

Testimonials Reflecting Benefits and Challenges

Testimonials from fellow digital nomads reveal common sentiments regarding family health insurance plans. These reflections often highlight both the advantages and challenges faced along the way.

- Maria from Mexico: “Having a family health insurance plan has given us peace of mind. We’ve traveled to various countries, and knowing we are covered in case of emergencies is invaluable.” This demonstrates the confidence that comes with adequate coverage.

- David from Canada: “Initially, I went for the cheapest option. It was only after an unexpected dental emergency that I realized it wasn’t worth the savings. Investing in proper insurance has saved me a lot of hassle.” This illustrates the pitfalls of prioritizing cost over comprehensive coverage.

- Anna from Germany: “We learned the hard way that not all insurance plans are equal. After facing challenges in getting reimbursement from our previous provider, we switched to a more reliable company that understands the needs of digital nomads.” This showcases the importance of utilizing reputable insurers that cater specifically to nomads.

Final Summary

In conclusion, securing Family Health Insurance for Digital Nomads is not just a practical necessity but a cornerstone for peace of mind while traveling. By understanding the various insurance options and challenges, families can ensure they are adequately covered no matter where their journey takes them. Embrace the adventure of nomad life fully equipped for any health-related surprises that may arise along the way.

FAQs

What is family health insurance for digital nomads?

It is a health insurance plan specifically designed to cover families who travel frequently, offering protection regardless of their location.

How does family health insurance differ from traditional plans?

Family health insurance for digital nomads typically offers more flexible coverage options across various countries, while traditional plans may be more localized and restrictive.

Are there specific providers that specialize in insurance for digital nomads?

Yes, there are several insurance providers that focus on nomadic lifestyles, offering tailored plans for families.

Can I use my family health insurance while living abroad?

Yes, many family health insurance plans for digital nomads provide international coverage, allowing you to access healthcare services while traveling.

What should I look for in a family health insurance plan?

Consider factors like coverage limits, network of providers, emergency services, and the specific needs of your family when selecting a plan.

How can I manage costs associated with family health insurance?

Explore options such as comparing different providers, looking for discounts, and understanding the coverage you truly need to avoid unnecessary expenses.