Short-Term Health Insurance For Digital Nomads

Short-Term Health Insurance for Digital Nomads is a crucial safety net for those who choose to wander the globe while working remotely. As digital nomadism becomes increasingly popular, understanding the unique health insurance needs of this lifestyle is essential. Short-term plans offer flexibility and tailored coverage that align with the unpredictable nature of travel, ensuring peace of mind as you explore new destinations.

This insurance option is designed for individuals who may not need long-term coverage but still require protection against unexpected medical expenses. Comparatively, it stands out from traditional health insurance by providing shorter contract durations and more straightforward application processes, making it ideal for those frequently on the move.

Understanding Short-Term Health Insurance

Short-term health insurance is a flexible and temporary solution designed to provide coverage during gaps in healthcare needs. For digital nomads, who often travel from one country to another, this type of insurance is particularly beneficial as it offers essential medical coverage without the long-term commitment and complexities associated with traditional plans. Understanding this insurance can help nomads navigate their health needs efficiently, ensuring peace of mind while exploring the world.

Short-term health insurance typically covers a limited range of medical services for a shorter duration, usually between a few months up to a year. This type of insurance is crucial for digital nomads who may not have a permanent residence or a consistent healthcare provider. Short-term plans are often less expensive compared to traditional health insurance, making them an appealing option for those who need flexibility and affordability.

Key Features and Benefits of Short-Term Health Insurance Plans

Short-term health insurance plans come with several noteworthy features and benefits that cater specifically to the needs of digital nomads. Understanding these can help individuals make informed choices about their health coverage.

- Flexibility: Short-term plans can be purchased for specific durations, allowing digital nomads to choose coverage that aligns with their travel schedules.

- Cost-Effective: These plans usually have lower monthly premiums than traditional health insurance, making them accessible for those on the move.

- Immediate Coverage: Many short-term plans offer quick approval and coverage, which is vital for travelers who need immediate medical assistance.

- Customization: Nomads can often tailor plans to include specific benefits that fit their lifestyle, such as international coverage or trip interruption coverage.

- No Network Restrictions: Unlike traditional plans that may limit provider choices, short-term insurance often allows for broader access to healthcare providers.

Differences Between Short-Term Health Insurance and Traditional Health Insurance

There are distinct differences between short-term health insurance and traditional health insurance that are important for digital nomads to understand, as the choice may significantly impact their travel experience.

- Coverage Duration: Short-term insurance is designed for temporary needs, while traditional plans usually require a commitment for at least a year.

- Scope of Coverage: Short-term plans often have limited coverage and may exclude pre-existing conditions, whereas traditional plans typically offer comprehensive coverage including preventive care.

- Premiums: Monthly premiums for short-term plans are generally lower, but they may require higher out-of-pocket costs for medical services compared to traditional insurance.

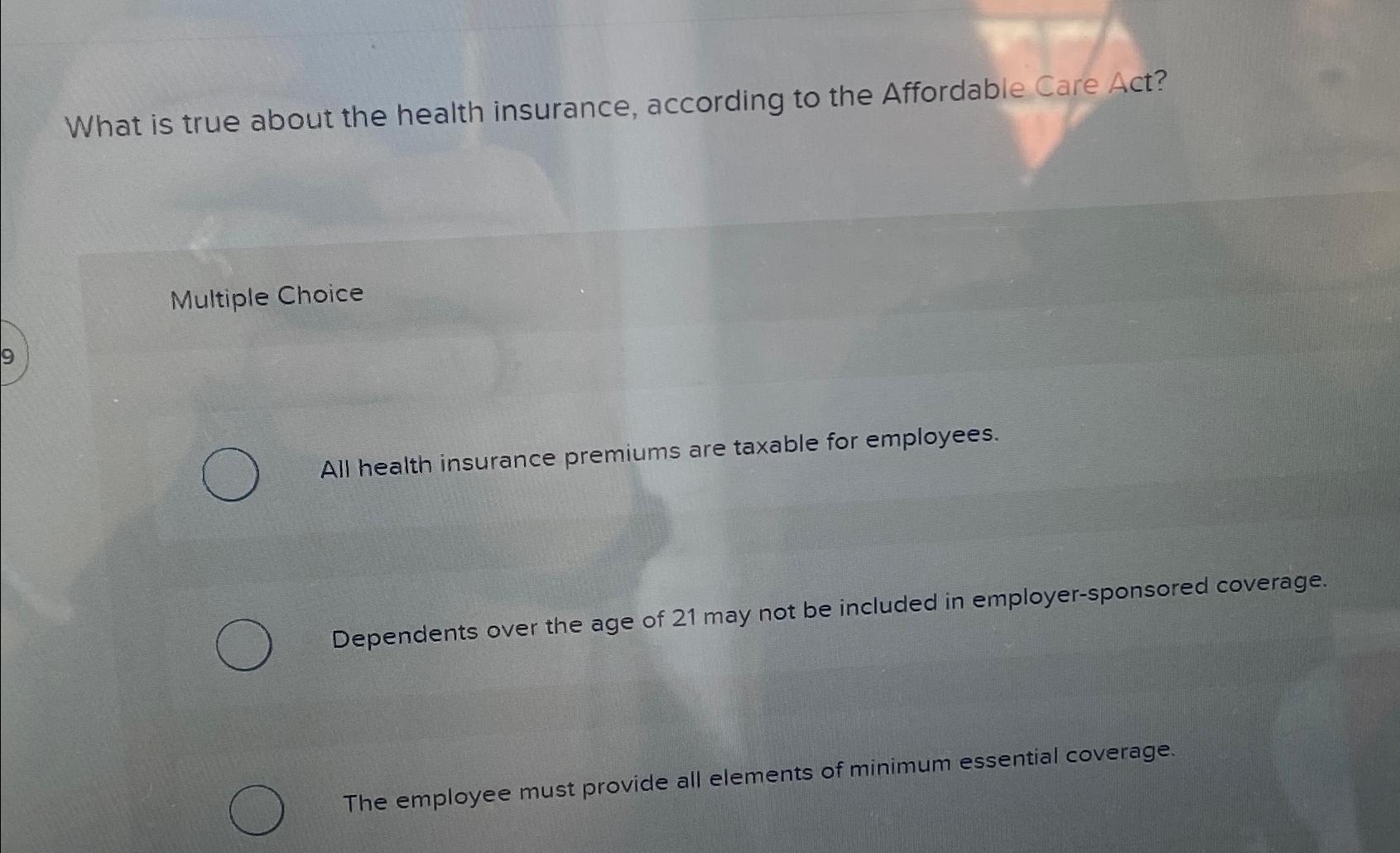

- Regulatory Standards: Traditional health insurance is subject to strict regulations under the Affordable Care Act (ACA), ensuring minimum coverage standards, while short-term plans often do not comply with these requirements.

- Renewability: Short-term plans are not renewable, meaning policyholders must reapply for coverage after their term expires, while traditional plans can be renewed annually.

Short-term health insurance serves as a crucial safety net for digital nomads, offering flexibility and affordability during their travels.

Suitability for Digital Nomads

Short-term health insurance is increasingly becoming a staple for digital nomads, catering to their unique lifestyle and travel needs. These individuals often work remotely while traversing various countries, making traditional long-term health insurance plans less practical. Short-term health insurance provides the flexibility and coverage needed during their adventures without the commitment of long-term contracts.

This type of insurance is ideal for digital nomads primarily due to its adaptability. Unlike traditional health insurance, which may require lengthy application processes and commitments, short-term plans are designed for those who are constantly on the move. Digital nomads can purchase these plans for specific durations, allowing them to align their health coverage with their travel itinerary. Consider the various situations where these nomads might find short-term coverage invaluable.

Examples of Situations Requiring Short-Term Coverage

Digital nomads can encounter unexpected health issues or accidents while traveling, making short-term health insurance a vital resource. Here are a few scenarios where having this coverage proves essential:

- Injury while participating in adventure sports: A digital nomad hiking in the mountains of Peru may suffer an ankle injury. Short-term health insurance can cover the medical expenses associated with the injury, ensuring they receive timely treatment.

- Illness during international travels: A nomad working remotely in Thailand might contract a stomach virus from street food. With short-term health insurance, they can visit a local clinic without incurring exorbitant out-of-pocket costs.

- Accidents while using local transportation: If someone traveling in Vietnam is involved in a scooter accident, having short-term health insurance can help cover the emergency services needed for treatment.

The flexibility of short-term health insurance allows digital nomads to address their health needs as they arise, ensuring peace of mind while they explore the globe.

Case Studies of Digital Nomads Benefiting from Short-Term Health Insurance

There are numerous stories of digital nomads who have successfully navigated health challenges thanks to short-term health insurance. One case involves a digital marketer from Canada who fell ill while attending a work conference in Amsterdam. The absence of pre-existing coverage for traveling abroad left him vulnerable; however, purchasing a short-term policy right before his trip enabled him to seek medical assistance without financial strain.

Another example involves a couple of travel bloggers who faced a sudden medical emergency when one partner developed appendicitis while they were in Bali. Their short-term health insurance plan covered the hospital stay and surgery, allowing them to focus on recovery rather than worrying about the costs.

These narratives underscore the importance of having accessible and reliable health coverage for digital nomads, highlighting how short-term health insurance can serve as a safety net during their international adventures.

Comparing Plans and Providers

Selecting a short-term health insurance plan is crucial for digital nomads who often face unique health care needs while traveling. With a variety of providers and plans available, understanding the differences can significantly influence your experience and financial security during your travels.

When comparing plans, consider factors such as coverage limits, network of doctors, deductibles, and the specific needs of your lifestyle as a digital nomad. The right plan should not only provide essential health coverage but also fit seamlessly into your travel lifestyle. Below is a comparative table of several short-term health insurance providers that cater specifically to digital nomads.

Comparison of Short-Term Health Insurance Providers

The following table Artikels key features of various short-term health insurance providers, enabling digital nomads to make informed decisions based on their individual needs.

| Provider | Coverage Duration | Network Size | Deductibles | Monthly Premiums |

|---|---|---|---|---|

| World Nomads | Up to 12 months | Large global network | $0 – $500 | $100 – $200 |

| IMG | 5 days to 12 months | Extensive network | $0 – $1000 | $50 – $150 |

| SafetyWing | Monthly | Global network | $0 – $250 | $40 – $100 |

| Insured Nomads | 1 month to 12 months | Large network | $100 – $500 | $90 – $180 |

Factors to consider when selecting a short-term health insurance plan include the following:

- Coverage Limits: Look for plans that provide adequate coverage for medical emergencies, hospitalization, and outpatient services. Ensure that the coverage aligns with your travel destinations’ health care costs.

- Network of Providers: A large network can offer more flexibility in choosing doctors and hospitals, especially when traveling abroad.

- Deductibles and Copayments: Understand your out-of-pocket expenses and how they affect your overall costs. Lower deductibles may result in higher premiums, so balance is key.

- Exclusions and Limitations: Carefully read the fine print to identify any exclusions that could affect your coverage, such as pre-existing conditions or specific activities.

- Claim Process: A straightforward claim process can make a significant difference in your experience. Look for providers with good customer support and easy claim submission.

Pros and Cons of Different Coverage Options

Understanding the advantages and disadvantages of various coverage options is essential for digital nomads. Different plans may cater to specific needs and situations.

- Pros:

- Flexibility in Duration: Many short-term plans offer flexibility in terms of coverage duration, allowing you to pay for only what you need while traveling.

- Affordability: Short-term health insurance can be more budget-friendly than long-term plans, especially for those who do not require extensive coverage.

- Coverage for Emergencies: Most plans provide essential coverage for medical emergencies, which is critical when traveling in unfamiliar areas.

- Cons:

- Limited Coverage: Short-term plans often have limitations on the types of care covered, including exclusions for pre-existing conditions.

- High Out-of-Pocket Costs: Some plans may come with high deductibles or copayments, resulting in unexpected expenses during medical emergencies.

- Shorter Coverage Periods: For long-term travelers, short-term plans may not provide continuous coverage, necessitating frequent plan renewals.

Choosing the right short-term health insurance requires careful consideration of individual needs, travel plans, and the specific details of each provider’s offerings.

How to Apply for Short-Term Health Insurance

Applying for short-term health insurance can often feel like navigating a complex maze, especially for digital nomads who are constantly on the move. However, by following a clear step-by-step process, you can simplify the application experience and secure the coverage you need.

First, it’s essential to know that applying for short-term health insurance typically involves several key steps. Each step is designed to ensure that you provide the necessary information and documentation to the insurance provider. This process may vary slightly between different insurance companies, but the core elements remain similar.

Step-by-Step Application Process

To help you understand the application process better, here’s a straightforward breakdown:

1. Research Providers: Start by researching various insurance providers that offer short-term health insurance suitable for digital nomads. Review their plans, benefits, and limitations.

2. Select a Plan: Choose a plan that fits your travel needs, duration, and budget. Consider aspects such as coverage limits, deductibles, and benefits.

3. Gather Necessary Documentation: Before applying, collect the required documentation. This may include personal identification, proof of travel itinerary, and any medical history if necessary.

4. Complete the Application: Fill out the application form provided by your chosen insurance company. Ensure you provide accurate and complete information to avoid delays.

5. Submit Your Application: Once your application is complete, submit it according to the provider’s instructions. This could be online, via email, or through postal mail.

6. Review Your Policy: After receiving your policy documents, review them carefully. Understand the terms, conditions, and coverage details to ensure it meets your needs.

7. Make Payment: Pay the required premium to activate your policy. Confirm the payment methods accepted by the provider.

8. Keep Proof of Insurance: After your application is processed and your policy is active, keep a copy of your insurance card and policy documents accessible during your travels.

Tips for Gathering Documentation

Collecting the right documentation is crucial for a smooth application process. Here are some tips to streamline this step:

– Keep scanned copies of important documents on your devices, ensuring you have them readily available.

– Organize your identification, travel documents, and medical history in a dedicated digital folder.

– Contact your insurance provider beforehand to confirm specific documentation requirements.

Application Checklist for Digital Nomads

To help you ensure that you have everything in order for your application, here’s a handy checklist:

- Research and select an insurance provider

- Determine the appropriate short-term health insurance plan

- Gather identification documents (passport, driver’s license)

- Prepare proof of travel itinerary (flight bookings, accommodation details)

- Compile any necessary medical history or records

- Complete the application form accurately

- Review your policy details upon receipt

- Make payment and keep proof of insurance handy

“Being well-prepared with your documentation can save time and reduce stress during your insurance application process.”

Coverage Limitations and Exclusions

When selecting short-term health insurance, it’s essential to understand that these policies often come with various limitations and exclusions. Being aware of these factors helps ensure that you have realistic expectations about the coverage you will receive while traveling. Many travelers, especially digital nomads, may find that certain health services are not covered, potentially leading to unexpected expenses.

Common limitations in short-term health insurance policies can significantly impact your healthcare options. These plans typically cover essential medical needs but may exclude certain services, leaving travelers vulnerable in specific situations. Understanding these exclusions can help you make informed decisions about your health coverage while abroad.

Common Exclusions in Short-Term Health Insurance

Many short-term health insurance policies include exclusions that can affect your overall health care access. Recognizing these exclusions can help you prepare for potential out-of-pocket costs.

- Pre-existing Conditions: Most short-term plans do not cover any medical issues that existed before the policy effective date. This means that if you receive treatment for a chronic illness, it won’t be covered, leading to significant expenses.

- Preventive Care: Routine check-ups, vaccinations, and screenings typically fall outside the coverage of short-term insurance. This can be crucial for travelers who need preventive services to maintain their health.

- Maternity Care: Services related to pregnancy, including prenatal and postnatal care, are generally excluded. If you are pregnant or planning to conceive, this is a critical factor to consider.

- Dental and Vision Care: Dental and vision services, including routine exams and treatments, are often not covered. Travelers may need to seek separate insurance for these specific needs.

- Emergency Medical Evacuation: While some policies may cover emergency medical transport, many do not include this crucial service, which can be costly in case of a serious health issue requiring evacuation.

“Understanding the limitations of your health insurance can prevent unexpected financial burdens during your travels.”

Managing Expectations Regarding Coverage

Traveling abroad often introduces unique health risks and situations that differ from those faced at home. Therefore, it’s vital for digital nomads to manage their expectations regarding coverage. Many assume that short-term insurance will mirror the comprehensive health plans they may have back home, leading to disappointment when they discover the reality.

Understanding the specific coverage limitations can help travelers prepare adequately. For instance, if you know that preventive care is not included, you can seek those services before traveling or look for additional coverage options. Moreover, researching local healthcare systems in your travel destinations can provide insight into what services are available and what to expect should you need medical attention.

By taking proactive steps to understand these limitations and exclusions, digital nomads can navigate their health coverage more effectively, ensuring they are prepared for any unforeseen medical needs while on the road.

Tips for Maximizing Benefits

Navigating short-term health insurance as a digital nomad can be challenging, but with the right strategies, you can get the most out of your plan. From understanding your coverage to knowing when to seek care, these tips will help ensure you stay healthy and protected while traveling.

Utilizing short-term health insurance effectively requires awareness of the benefits and limitations of your specific plan. To maximize these benefits, consider the following strategies that can enhance your experience and give you peace of mind while on the move.

Understanding Your Plan’s Coverage

It’s crucial to know exactly what your short-term health insurance covers to avoid unexpected out-of-pocket costs. Familiarize yourself with key aspects of your plan, including:

- In-Network Providers: Seek care from in-network healthcare providers to benefit from lower co-pays and coverage percentages.

- Emergency Services: Understand the protocol for emergency services to ensure you receive the necessary care without incurring excessive charges.

- Preventive Care: Take advantage of any preventive services offered, such as vaccinations or screenings, which can keep you healthy and potentially avoid more serious health issues.

Documenting Health Needs

Keep a detailed record of any pre-existing conditions, medications, and allergies. This information is essential when seeking care abroad and helps healthcare providers make informed decisions.

“Being proactive with your health documentation can streamline your treatment process in unfamiliar environments.”

Choosing the Right Care Providers

When you’re in a new country, selecting the right healthcare provider can impact your treatment experience significantly. Here are some tips for finding quality care:

- Research Local Providers: Look for highly-rated hospitals or clinics through online platforms or local recommendations.

- Contact the Insurance Provider: Ask your insurance company for a list of recommended providers in the area.

- Check Reviews: Use platforms like Google or Yelp to read reviews from previous patients about their experiences.

Health-Related Scenarios, Short-Term Health Insurance for Digital Nomads

There are various health-related scenarios where utilizing your short-term insurance becomes essential. Here are a few examples:

- Accidents: Whether you’re hiking in the mountains or biking through a city, accidents can happen anytime, making immediate medical attention necessary.

- Acute Illness: If you travel to a region where you might be exposed to different illnesses, prompt medical assistance could be crucial for diseases like food poisoning or infections.

- Routine Check-ups: While traveling, maintaining your health through routine check-ups is important, especially if you have chronic conditions that require monitoring.

Frequently Encountered Issues

Digital nomads often face unique challenges when relying on short-term health insurance. Understanding these issues is essential for effective navigation of the healthcare system while traveling. This section will highlight common problems and provide insights on how to resolve disputes, along with useful resources for obtaining assistance.

Common Issues Faced by Digital Nomads

Digital nomads frequently encounter a variety of challenges while utilizing short-term health insurance. These issues may include limited coverage, high out-of-pocket costs, and confusion regarding claim processes. Understanding these pitfalls can help digital nomads better prepare for their health insurance needs.

- Limited Provider Networks: Many short-term health insurance plans have restricted networks of healthcare providers, which can result in higher costs if care is needed outside of these networks.

- Lack of Comprehensive Coverage: Short-term plans may not cover essential health services, such as preventive care, maternity care, or mental health services, which can leave gaps in coverage.

- Difficulty in Claim Processing: Claim procedures can sometimes be complex and time-consuming, leading to frustration for policyholders when trying to receive reimbursements for medical expenses.

- Pre-existing Condition Exclusions: Many short-term health insurance policies exclude coverage for pre-existing conditions, which can leave digital nomads vulnerable if they require treatment for ongoing health issues.

Resolving Disputes with Insurance Providers

When disputes arise with insurance providers, digital nomads need to know how to effectively address and resolve these issues. Taking the proper steps can lead to a satisfactory outcome and ensures clarity in coverage.

- Review Policy Documentation: It is crucial to thoroughly read the insurance policy to understand coverage limits and exclusions before filing a claim. This knowledge can help in addressing disputes.

- Maintain Clear Communication: Initiating contact with the insurance provider through phone or email can clarify misunderstandings. Always document conversations for future reference.

- File a Formal Appeal: If a claim is denied, policyholders have the right to file an appeal. This process typically involves submitting additional documentation to support the claim.

- Seek Assistance from Regulatory Bodies: If disputes remain unresolved, contacting a state insurance department or regulatory body can provide additional support and guidance.

Resources for Digital Nomads Needing Assistance

Finding reliable resources is essential for digital nomads dealing with health coverage issues. Several organizations and platforms can provide valuable assistance.

- Expat Insurance Brokers: Specialized brokers can help digital nomads find and compare short-term health insurance options tailored to their needs.

- Online Communities: Joining forums or social media groups dedicated to digital nomadism can offer peer support and shared experiences regarding health insurance challenges.

- Health Insurance Advocacy Organizations: Nonprofits dedicated to consumer rights and health coverage can offer guidance and resources for navigating disputes with insurance providers.

- Government Health Websites: Many countries have official health department websites that provide information about local healthcare systems and insurance options available to travelers.

Epilogue: Short-Term Health Insurance For Digital Nomads

In summary, Short-Term Health Insurance for Digital Nomads provides a practical solution for ensuring health coverage while embracing the freedom of a nomadic lifestyle. By understanding your options and selecting the right plan, you can focus on your adventures without the burden of healthcare worries. Remember, being prepared is key to enjoying your travels to the fullest.

Helpful Answers

What is short-term health insurance?

Short-term health insurance provides temporary coverage for unexpected medical events, typically lasting from a few months to a year.

Who should consider short-term health insurance?

Digital nomads, freelancers, or anyone between jobs who needs flexible health coverage while traveling should consider it.

Can I renew my short-term health insurance?

Many providers allow for renewal, but it’s essential to check the specific terms of your plan as conditions may vary.

Are pre-existing conditions covered by short-term health insurance?

Generally, short-term plans do not cover pre-existing conditions, so it’s crucial to review the policy details.

How do I file a claim?

Claim processes vary by provider, but usually involve submitting a claim form along with relevant medical documentation.