Travel Insurance For Nomads With Pre-Existing Conditions

Travel Insurance for Nomads with Pre-Existing Conditions is a crucial consideration for those who embrace a life of adventure while managing existing health issues. Understanding the complexities of travel insurance can empower nomads to explore the world confidently, ensuring that they are protected against unforeseen medical expenses. With various policies available that cater specifically to the unique needs of nomads, it’s essential to navigate this landscape wisely.

In this guide, we will explore the importance of travel insurance, particularly for those with pre-existing conditions, the types of policies available, and practical tips to help nomads select the best coverage for their needs. From application processes to real-life experiences, we aim to provide a comprehensive overview to support your travels.

Understanding Travel Insurance: Travel Insurance For Nomads With Pre-Existing Conditions

Travel insurance serves as a vital safety net for globetrotters, particularly for nomads who journey continuously and may face unpredictable situations. With travel comes a multitude of risks, from minor inconveniences like flight delays to serious medical emergencies. For nomads with pre-existing conditions, securing appropriate travel insurance is crucial to ensuring peace of mind while exploring the world.

Travel insurance operates on the principle of risk management, providing financial protection against unforeseen events that could disrupt travel plans. By paying a premium, travelers can receive compensation for various incidents, such as trip cancellations, lost luggage, or medical emergencies. The coverage can vary widely depending on the policy, including options for emergency medical expenses, repatriation, and trip interruption.

Types of Coverage Available

Understanding the various types of coverage available can help nomads choose the most suitable insurance for their needs. The main types of travel insurance coverage include:

- Medical Coverage: This is essential for anyone traveling abroad, especially for those with pre-existing conditions. It covers costs related to unexpected medical emergencies, hospital stays, and necessary treatments.

- Trip Cancellation/Interruption: This coverage protects travelers against financial loss if they need to cancel or cut short their trip due to valid reasons like illness, family emergencies, or natural disasters.

- Lost or Stolen Luggage: Providing reimbursement for lost, damaged, or stolen luggage, this coverage can alleviate the stress of replacing essential items while traveling.

- Emergency Evacuation: This crucial coverage ensures that travelers receive immediate transport to a medical facility in case of severe injury or illness, particularly in remote locations.

Each type of coverage plays a significant role in comprehensive protection during travels. It’s important to evaluate personal travel habits, health needs, and potential risks when selecting a policy.

Key Factors to Consider When Selecting a Policy

Choosing the right travel insurance policy involves careful consideration of several key factors to ensure adequate coverage.

Firstly, the policy limits and exclusions should be reviewed meticulously. Understanding the maximum coverage amounts and any specific exclusions related to pre-existing conditions can help avoid unpleasant surprises during emergencies.

Secondly, the claims process is crucial. It’s beneficial to select a provider known for its efficient claims handling and customer support, as timely assistance can significantly impact recovery during emergencies.

Lastly, it’s essential to compare rates and benefits from multiple insurers. While cost is a factor, the cheapest option may not always provide the necessary coverage. Taking the time to scrutinize different policies and reading customer reviews can lead to a more informed decision.

Selecting the right travel insurance policy ensures that nomads can travel with confidence, knowing that they are protected against unforeseen circumstances.

Importance of Coverage for Pre-Existing Conditions

Traveling when you have pre-existing medical conditions adds a layer of complexity to your trip, especially when it comes to securing the right travel insurance. Coverage for these conditions is not just an optional extra; it’s essential for ensuring peace of mind and financial protection while abroad. Understanding the significance of having this coverage can save travelers from potentially devastating medical bills and stress during their journeys.

Pre-existing conditions refer to any health issues that existed before purchasing an insurance policy. Insurers typically view these conditions as higher risk, which is why understanding how different insurance companies assess them is crucial for travelers. The implications of not having adequate coverage can be severe, including significant out-of-pocket expenses or, in extreme cases, lack of necessary medical care.

Common Pre-Existing Conditions and Their Implications

Several common pre-existing conditions can impact travel insurance policies, and awareness of these can help travelers make informed choices. Conditions such as asthma, diabetes, heart disease, and even mental health disorders like anxiety and depression often require specific coverage considerations.

For instance, consider diabetes: a traveler with this condition may face challenges in securing coverage for complications related to high or low blood sugar levels while abroad. Without proper coverage, any emergency hospitalization could lead to substantial costs. Similarly, a traveler with asthma might need to consider how changes in climate or air quality can affect their health, which could complicate insurance claims if their condition worsens during travel.

Insurance providers differ significantly in how they assess pre-existing conditions. Some may offer coverage with exclusions, while others might provide policy options specifically designed for travelers with certain conditions. The key factors influencing this assessment include:

- Time since diagnosis: The longer it has been since the condition was diagnosed and stable, the more likely insurers will provide coverage.

- Control over the condition: Well-managed conditions with regular medical follow-ups are often viewed more favorably by insurers.

- Severity of the condition: More serious conditions may lead to higher premiums or limitations on coverage.

- Documentation: Insurers typically require medical records or statements from healthcare providers to evaluate risk accurately.

Understanding these factors can help travelers navigate the complexities of securing travel insurance that adequately covers their pre-existing conditions. It’s essential to read policy details carefully and communicate openly with insurance agents to ensure that all health concerns are accounted for before embarking on any trip.

Types of Policies Available for Nomads

For nomads, selecting the right travel insurance is crucial, especially when pre-existing conditions are involved. Various policies are designed to cater specifically to the unique needs of travelers who are constantly on the move. Understanding the landscape of available options helps nomads make informed decisions about their health and financial protection during their travels.

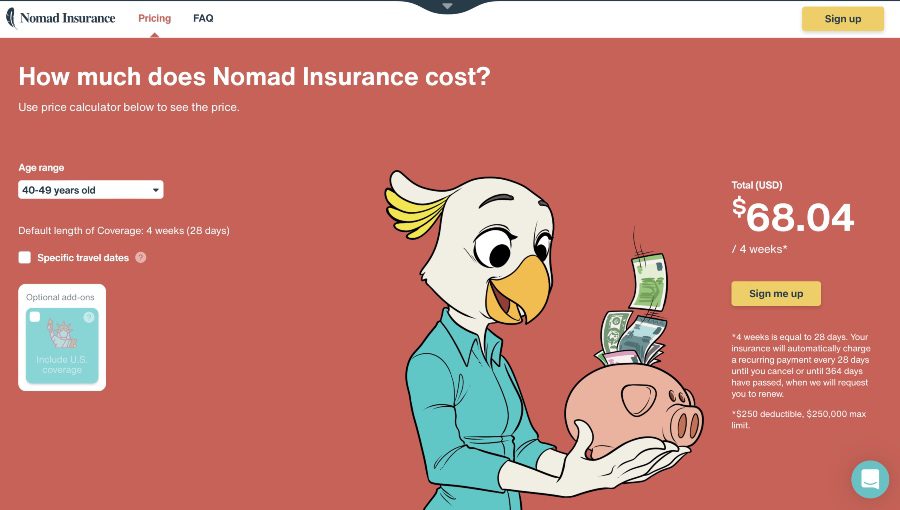

Travel insurance for nomads can vary significantly in terms of coverage, exclusions, and adaptability to long-term travel. It’s essential to compare different policies to find the one that best suits individual needs, particularly when pre-existing conditions come into play. Below is a comparison of notable travel insurance providers focusing on their coverage and limitations concerning pre-existing conditions.

Comparison of Top Travel Insurance Providers

Here’s a comprehensive table that highlights some of the key travel insurance providers for nomads, detailing their coverage options and limitations for pre-existing conditions:

| Provider | Coverage for Pre-Existing Conditions | Limitations |

|---|---|---|

| World Nomads | Comprehensive coverage, including some pre-existing conditions if stable 60 days prior to travel. | Exclusions apply for high-risk activities. |

| SafetyWing | Offers coverage for certain pre-existing conditions after 180 days of being stable. | Not all conditions are covered; check specific policy details. |

| IMG Global | Coverage for pre-existing conditions if covered by an additional rider. | Must apply rider within 24 hours of trip deposit. |

| Allianz Global Assistance | Pre-existing conditions covered if purchase occurs within 14 days of first trip payment. | Coverage varies by state; specific exclusions may apply. |

| AXA Assistance USA | Provides coverage for pre-existing conditions if medically cleared before travel. | Policy limits may vary; check individual terms. |

When tailoring policies to fit nomadic lifestyles, consider the following factors to enhance coverage effectively:

- Length of Travel: Policies should accommodate long durations, with options for extensions.

- Destination Flexibility: Ensure the policy covers multiple countries and regions.

- Activity Coverage: Look for policies that include coverage for adventure sports or activities.

- Emergency Assistance: Verify that 24/7 emergency support is available, crucial for nomadic travelers.

- Customizable Options: Seek policies that allow adjustments based on travel plans and pre-existing conditions.

“Choosing the right travel insurance is not just about price; it’s about finding the right fit for your unique travel lifestyle and health status.”

Application Process and Documentation

Applying for travel insurance, especially with pre-existing conditions, can seem like a daunting task. However, understanding the steps involved and gathering the necessary documentation can streamline the process. This section Artikels the application process and highlights what you need to have on hand to ensure a smooth experience.

Steps Involved in Applying for Travel Insurance

The application process for travel insurance typically follows a series of structured steps. Familiarizing yourself with these can help you move through the application with confidence.

1. Research and Compare Policies: Start by researching various insurers that offer travel insurance for nomads with pre-existing conditions. Compare coverage options, policy limits, and exclusions.

2. Obtain a Quote: Most insurance companies will provide an online quote feature. Input your details, including any pre-existing conditions, to receive tailored quotes.

3. Fill Out the Application: Once you choose a policy, complete the application form. This will require personal information, travel details, and specifics about your pre-existing conditions.

4. Provide Required Documentation: Gather the necessary documents as Artikeld below. Insurers may request additional medical information or assessments.

5. Review Terms and Conditions: Carefully read the policy’s terms and conditions, paying special attention to the coverage of pre-existing conditions.

6. Make the Payment: After reviewing the policy, make the payment to ensure your coverage is active.

7. Receive Policy Confirmation: Upon payment, you will receive a confirmation of your policy. Keep this document accessible for your travels.

Necessary Documentation for the Application Process, Travel Insurance for Nomads with Pre-Existing Conditions

Having the correct documentation prepared can significantly ease your application process. Below is a list of necessary documents that you may need to submit:

– Personal Identification: A valid passport or government-issued photo ID is required.

– Travel Itinerary: Details of your travel plans, including destinations and dates.

– Medical Records: Documentation of your pre-existing condition(s), including diagnosis and treatment history.

– Physician’s Statement: A letter from your doctor may be needed, outlining your condition and current health status.

– Prescription Information: Copies of prescriptions for any medications you plan to take while traveling.

– Previous Insurance Policies: If you have had travel insurance before, providing details of those policies can be helpful.

Common Challenges and Navigation Strategies

While applying for travel insurance with pre-existing conditions, several challenges may arise. Recognizing these can help you develop strategies to navigate them effectively.

– Disclosed Conditions: Accurately disclosing all pre-existing conditions is crucial. Failure to do so may result in denial of claims. It’s best to be thorough and transparent.

– Higher Premiums: Expect higher premiums due to pre-existing conditions. Compare quotes to find the best coverage that fits your budget without compromising on essential health needs.

– Policy Exclusions: Many policies come with exclusions related to pre-existing conditions. Carefully read through the exclusions to avoid surprises during your travels.

– Medical Underwriting: Insurers may require additional medical underwriting, which can delay the application process. Prepare your medical documents in advance to expedite this step.

– Follow-Up: After submission, follow up with the insurer to ensure your application is being processed and to address any additional requests promptly.

“Navigating the application process for travel insurance is essential for gaining peace of mind during your travels, especially when dealing with pre-existing conditions.”

Claim Process and Considerations

Filing a claim for travel insurance can seem daunting, especially for nomads with pre-existing conditions. However, understanding the steps involved can ease the process and ensure you receive the benefits you are entitled to. This section breaks down the essential elements of filing a claim, provides critical information required, and offers tips for a successful claim experience.

The claim process typically involves several key steps, starting from the moment an incident occurs until the claim is approved or denied. Nomads with pre-existing conditions should be particularly meticulous in documenting their situations and adhering to the insurance provider’s requirements.

Filing a Claim for Travel Insurance

When submitting a claim, it’s crucial to have all necessary documentation in order to support your case. Below is a list of critical information needed when filing a claim:

- Policy Number: Ensure you have your travel insurance policy number readily available.

- Incident Details: Clearly Artikel the nature of the incident, including dates, locations, and descriptions of the event.

- Medical Records: Provide any relevant medical documentation that supports the condition you are claiming for, particularly concerning pre-existing conditions.

- Receipts and Invoices: Include receipts for any expenses incurred as a result of the incident, such as medical bills, travel changes, or accommodation costs.

- Witness Statements: If applicable, gather statements from any witnesses who can validate your claim.

- Claim Form: Complete the insurance provider’s claim form accurately, ensuring all information is consistent with your documentation.

In order to enhance the likelihood of a successful claim, consider the following tips:

-

Document Everything: Keep detailed records of all communications with your insurance provider, including emails and phone calls.

-

Notify Promptly: Inform your insurance provider about the incident as soon as possible to comply with any time limits specified in your policy.

-

Be Honest: Provide truthful information regarding your pre-existing conditions, as discrepancies can lead to claim denials.

-

Follow Up: Regularly check the status of your claim to ensure it is being processed and address any additional requests from your insurer promptly.

-

Seek Assistance: If your claim is denied, consider consulting a professional who specializes in insurance claims to guide you through the appeals process.

Tips for Choosing the Right Policy

When it comes to selecting travel insurance, especially for nomads with pre-existing conditions, the process can feel overwhelming. However, being informed and strategic can make all the difference in ensuring you’re adequately protected during your travels. A well-chosen policy will not only provide peace of mind but can also save you significant costs in the event of an unexpected situation.

Understanding the intricacies of travel insurance, particularly regarding pre-existing conditions, is crucial. Policies can vary widely, especially in their definitions of what constitutes a pre-existing condition, as well as their coverage limits and exclusions. Therefore, taking the time to evaluate various options is essential for finding the right fit.

Reading the Fine Print

Diving into the details of a travel insurance policy can reveal critical information that impacts coverage. It’s important to thoroughly read the fine print, as this is where you’ll find the exclusions and limitations of your policy. Common exclusions can include specific medical conditions, certain activities, or activities that are considered high-risk.

Understanding exclusions is key to avoiding unpleasant surprises when filing a claim.

A few key aspects to focus on include:

- Definitions of pre-existing conditions: How does the insurer define them? Are there any specific time frames that apply?

- Coverage limits: What is the maximum amount the insurer will pay for claims related to pre-existing conditions?

- Waiting periods: Are there waiting periods for coverage to begin after purchasing the policy?

- Activity exclusions: Does the policy exclude coverage for certain high-risk activities such as extreme sports or adventure travel?

Questions to Ask Insurers

When comparing policies, there are critical questions to ask potential insurers to clarify their terms and ensure you choose the best policy for your needs. Being proactive will help you gather all necessary information to make an informed decision.

Here’s a checklist of essential questions:

- What is the specific definition of a pre-existing condition in your policy?

- Is there a time frame in which my pre-existing condition must have been stable to qualify for coverage?

- What medical documentation is required to prove my pre-existing condition is stable?

- Are there any specific exclusions related to my condition that I should be aware of?

- What is the process for filing a claim if I need to use my coverage?

- How do you handle claims for pre-existing conditions during travels outside my home country?

By taking these steps and asking the right questions, nomads can ensure they select a policy that adequately covers their specific needs, allowing for a more enjoyable and worry-free travel experience.

Real-Life Experiences and Case Studies

Traveling as a nomad comes with its unique set of challenges, especially for those with pre-existing conditions. The importance of having the right travel insurance cannot be overstated, as illustrated by the real-life experiences of various nomads who faced health-related issues during their journeys. These stories not only highlight the necessity of coverage but also provide insights into how others navigated their own travel insurance needs effectively.

Case Studies of Nomads with Pre-Existing Conditions

Numerous nomads have shared their experiences regarding the impact of travel insurance on their health and travel plans. These stories often serve as valuable lessons for future travelers. One notable example is that of Sarah, who has asthma. While traveling through Southeast Asia, she faced a severe asthma attack and required immediate medical attention. Thanks to her travel insurance that included coverage for her pre-existing condition, she received timely treatment without bearing the hefty costs that would have otherwise arisen.

Another case involves Mark, who has a history of heart issues. He had planned a hiking trip in the Andes when he experienced chest pains. His insurance not only covered his medical expenses but also his evacuation from the remote area, demonstrating the crucial role of comprehensive travel insurance in emergency situations. Such experiences underline the importance of securing appropriate travel insurance before embarking on any journey.

“Travel insurance is not just a safety net; it’s an essential tool for peace of mind while exploring the world.”

Sharing testimonials and experiences from fellow nomads can greatly enhance the understanding of the importance of travel insurance for those with pre-existing conditions. Most travelers emphasize the need for thorough research when selecting a policy. They advise reading the fine print and ensuring that the specific pre-existing conditions are covered adequately.

In summary, these real-life scenarios serve as important reminders of the potential risks involved in traveling with pre-existing conditions. The lessons learned from these experiences can significantly influence future travel plans, guiding others to make informed decisions when it comes to their travel insurance needs.

Future Trends in Travel Insurance

As travel continues to evolve, so does the landscape of travel insurance. Nomads with pre-existing conditions are increasingly finding tailored coverage options that meet their unique needs. The future of travel insurance is not just about adaptation but also innovation, driven by technology, regulatory changes, and a growing understanding of the diverse needs of travelers.

Emerging trends indicate a shift toward more inclusive policies that consider various health conditions. The rise of technology is streamlining the insurance process, making it easier for travelers to access information, apply for coverage, and submit claims. This transformative phase in travel insurance is essential for ensuring that nomads can secure the coverage they need without unnecessary hurdles.

Technological Innovations in Travel Insurance

Technology is playing a pivotal role in reshaping travel insurance policies and processes. The integration of artificial intelligence (AI) and big data is enabling insurers to offer more personalized plans. By analyzing individual health profiles and travel history, AI can identify the specific needs of travelers with pre-existing conditions.

Some key technological advancements include:

- Online Platforms: Many insurance providers are transitioning to digital platforms, allowing users to compare policies, read reviews, and apply for coverage instantly.

- Mobile Applications: Users can manage policies, track claims, and receive updates directly through mobile apps, enhancing user experience and accessibility.

- Telemedicine Services: Insurers are starting to include telehealth consultations as part of their coverage, enabling travelers to receive medical advice remotely during their trips.

These innovations not only improve efficiency but also build confidence among travelers, particularly those with pre-existing conditions, who may have concerns about their health while abroad.

Potential Regulatory Changes Affecting Coverage

The regulatory landscape for travel insurance is also evolving, particularly concerning pre-existing conditions. As more consumers advocate for fair treatment and comprehensive coverage, regulators are beginning to take notice. Potential changes may include:

- Standardized Definitions: Efforts to standardize what constitutes a pre-existing condition could lead to clearer policies and expectations for consumers.

- Mandatory Coverage Guidelines: Some jurisdictions might introduce regulations requiring insurers to offer coverage for specific pre-existing conditions, ensuring that travelers are not left exposed.

- Consumer Protection Initiatives: Strengthened regulations may also focus on transparency, requiring insurers to clearly disclose terms and exclusions related to pre-existing conditions.

These changes could lead to a more equitable environment for nomads, ensuring that they have access to essential coverage without facing exorbitant costs or exclusions based on their health history.

“The future of travel insurance hinges on innovation and inclusivity, creating a safety net for every traveler, regardless of their health background.”

Ending Remarks

In summary, securing Travel Insurance for Nomads with Pre-Existing Conditions is an essential step in ensuring a safe and enjoyable journey. By understanding your options, the application process, and the claims procedures, you can travel with peace of mind. Embracing the world as a nomad shouldn’t be hindered by health concerns; the right insurance can make all the difference in your adventures.

Questions and Answers

What are pre-existing conditions in travel insurance?

Pre-existing conditions refer to health issues or illnesses that existed before the travel insurance policy was purchased. These conditions can significantly impact coverage options and costs.

Can I get travel insurance if I have a serious health condition?

Yes, many insurers offer policies specifically designed for travelers with serious health conditions, although coverage may vary based on the condition and the insurer’s guidelines.

Is it more expensive to insure a pre-existing condition?

Typically, yes. Insurers may charge higher premiums for policies that cover pre-existing conditions or may impose limitations on coverage.

How can I ensure my pre-existing condition is covered?

When applying for travel insurance, it is crucial to disclose all relevant health information. Review policy details carefully and ask the insurer about their coverage for pre-existing conditions.

What should I do if I need to file a claim related to a pre-existing condition?

Gather all necessary documentation, including medical records and receipts, and contact your insurer to start the claim process as soon as possible.